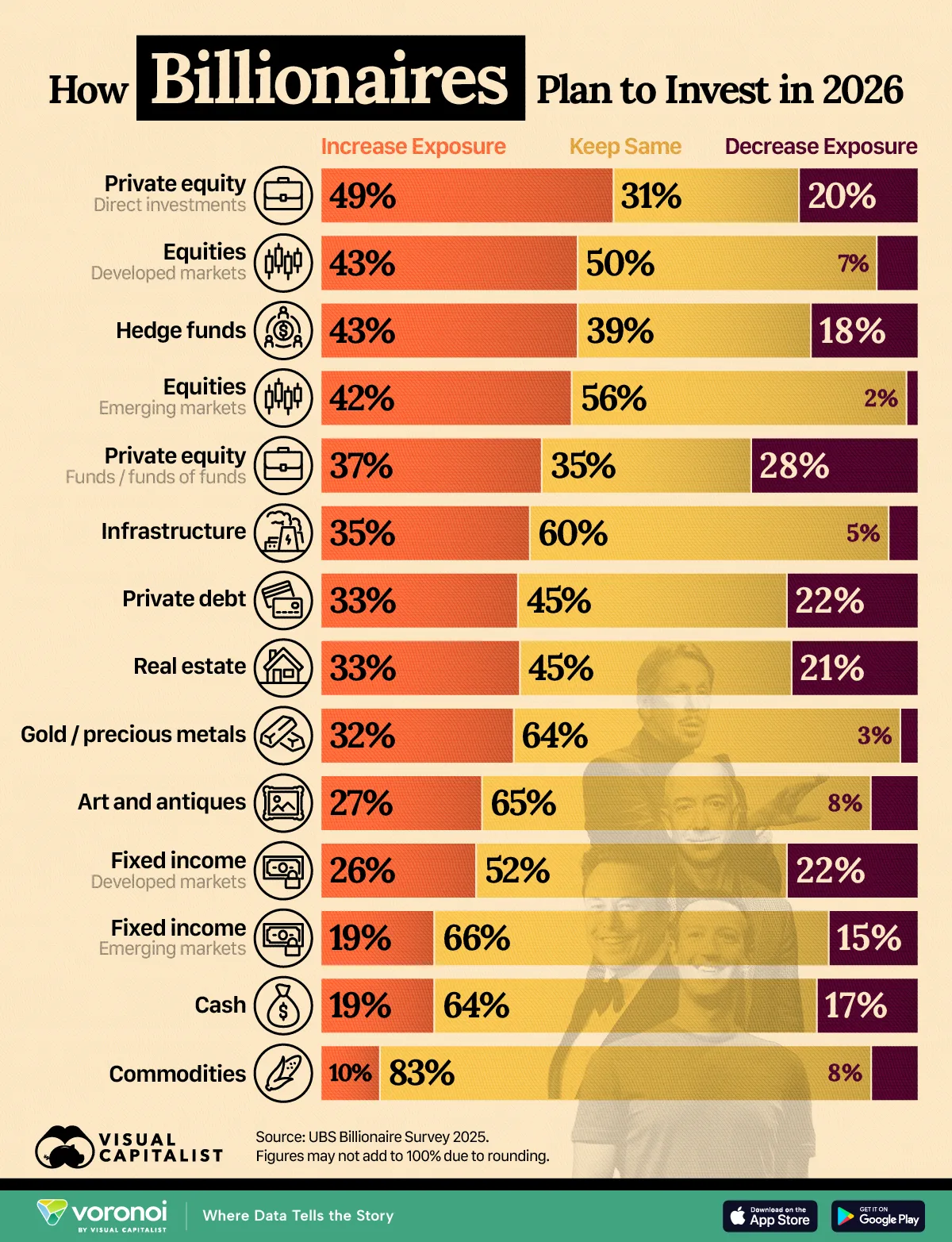

Risk appetite remains strong in 2026. Here’s what billionaires are investing in, according to a recent UBS survey.

How Billionaires Plan to Invest in 2026.

- Private equity, public equities, and hedge funds top the list for increased exposure.

- Risk appetite among billionaires remains strong in 2026.

Billionaires are entering 2026 with confidence. Despite ongoing geopolitical tensions, sticky inflation in some regions, and uneven global growth, the world’s wealthiest investors are not retreating to the sidelines.

This visualization highlights how billionaires expect to adjust their portfolios in 2026. It shows which asset classes they plan to increase, maintain, or reduce exposure to. The data for this visualization comes from the UBS Billionaire Survey 2025.

Private equity stands out as the most favored asset class. Nearly half of billionaires (49%) plan to increase exposure to direct private equity investments, while another 37% expect to boost allocations through private equity funds.

Founder & Managing Partner of Trajectory Capital and CEO Trajectory ALPHA Acquisition Corp NYSE: TCOA.

Lifetime entrepreneur, mentor, Board Member obsessed with the infinite realm of possibility in the digital transformation of the world. Founder & Board Member TruVest, MainBloq. Board Member Beasley Media (NASDAQ: BBGI) Kubient NASDAQ: KBNT, Fraud.Net, Hoo.Be, MediaJel