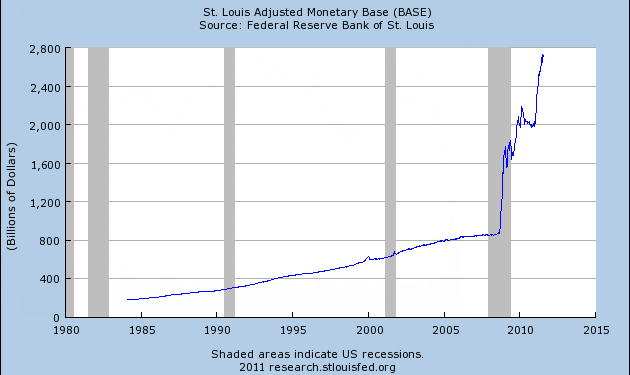

For more than six years, the U.S. Federal Reserve administered round after round of Quantitative Easing (QE), and only in recent years decided to scale back its operations. If the Fed had not stepped in in 2008, chances are the U.S. economy would have entered a deep depression, much worse than what was experienced. When QE was first put on the table following the financial collapse that gave way to the Great Recession, many people feared that it would ultimately lead to runaway inflation like the kind seen in Zimbabwe (and its 1 trillion dollar bill), Argentina, Hungary or the German Weimar Republic.

Prices did rise modestly during that period, but by historical measures inflation was subdued, and a far cry from being a hyperinflation. Why aren’t we all pushing around wheelbarrows full of banknotes to the supermarket? (For more, see: What’s the difference between Hyperinflation and Inflation?)

Why QE Didn’t Cause Hyperinflation

As the Great Recession set in, the Fed dropped its interest rate target to close to zero, and then was forced to use unconventional monetary policy tools including quantitative easing. It is important to realize that QE was an emergency measure used to stimulate the economy and prevent it from tumbling into a deflationary spiral.

When financial institutions collapse and there is a high degree of economic uncertainty, people and businesses choose to hoard their money rather than risk investment and potential loss. When money is hoarded, it is not spent and so producers are forced to lower prices in order to clear their inventories. But why would somebody spend a dollar today when they expect that prices will be lower – and their dollar can buy effectively more – tomorrow? The result is that hoarding continues, prices keep falling, and the economy grinds to a halt.

The first reason, then, why QE did not lead to hyperinflation is because the state of the economy was already deflationary when it began. After QE1, the fed underwent a second round…

The latest trend and news for the people by the people. Left right and center all in one place.