Each phase of an uptrend has unique factors that need strategic shifts in risk management and profit objectives. This is especially true when a security rallies to a new high that hasn’t been traded in its long-term history. This scenario can build wealth quickly but requires special technical rules to capitalize on the mechanics in play. (For related reading, see: Five Minute Investing: Stock Picking).

Momentum dynamics shift when a security reaches uncharted territory. The new high print signals very favorable conditions in which there’s no oversupply in the form of shareholders who need to sell at a loss or to get even. This lopsided equation can translate into rapid gains that often exceed logical price targets but can also generate unexpected behavior that encourages emotional decision-making. (See also: Avoid These Common Investing Psychology Traps).

Resistance disappears when a security hits an all-time high but hidden obstacles remain, ready to surprise unwary longs with reversals and shakeouts. While the breakout completes the digestion of prior supply, the security undergoes additional testing that can last weeks or months. This process has the power to trigger sizable losses that can be avoided with the first special rule, which categorizes the uptrend positioning in relation to the breakout.

Rule #1: Categorize The Breakout’s Progress

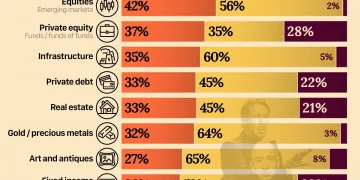

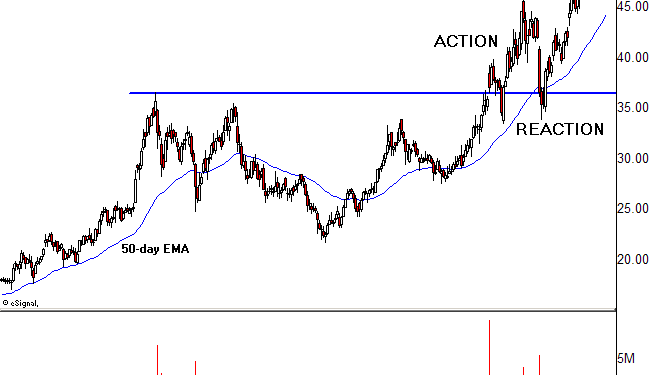

Breakouts to new highs tend to unfold in three distinct phases. First, price thrusts above resistance, attracting higher than average volume. This marks the “action”phase. Rally momentum eventually fades, with weak hands getting on board near the rally highs. This imbalance triggers the second or “reaction” phase, which tests the durability of the breakout. Support either holds, triggering a rally above the prior high that confirms the breakout, or it rolls over in a failure swing. Both outcomes complete the third or “resolution” phase.

Ambarella (AMBA) broke out above resistance at 36 in September and rallied to an all-time high in the mid-40s. This action phase gave way to a contrary reaction phase that dumps price back to new support and undercuts it for two sessions, shaking out weak hands. The security then recovered all of its losses and posted another round of all-time highs, completing the resolution phase.

Accumulation/distribution as measured by On Balance Volume (OBV) determines the path of least resistance, favoring rapid upside resolution when it hits new high, and whipsaws when it lags price development. (For more, read: Uncover Market Sentiment With On-Balance Volume). This makes sense because a security at an all-time high should generate widespread interest that translates into enthusiastic buying pressure. When it doesn’t, the trend needs to pause and find missing sponsorship or gravity can take control, unraveling the breakout.

Sidelined participants should avoid new long exposure during this testing phase, except at the range extremes where the risk/reward equation will work in their favor. These opportunities typically present themselves in the form of pullbacks to…

The latest trend and news for the people by the people. Left right and center all in one place.