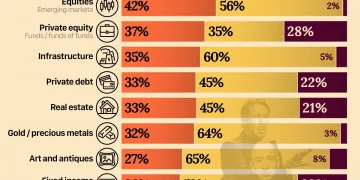

Both dividend yield and total return are terms used to describe the performance of a stock over a certain time period (usually one year) but they reflect different types of performance. Whether equity investors should focus on income generation, which includes dividend yield, or return is a contested topic in the financial world. In truth, the relative importance of each measurement likely depends on your individual circumstances and investment horizon. This does not mean you have to neglect one in favor of the other; it is wiser to take both into consideration before selecting an investment.

The Importance of Dividend Yield

Dividends are the portion of a company’s profits that are distributed to shareholders. It is considered a sign of clear financial health and confidence for a company to pay out dividends, which .are usually independent of share price. Dividend yield is a financial ratio that represents the dividend income per share divided by the price per share. For example, a stock priced at $100 per share that receives a dividend payment of $8 is said to have a yield of 8%.

For long-term investors, dividends can be very powerful, because they can be reinvested and used to purchase more shares, meaning…

The latest trend and news for the people by the people. Left right and center all in one place.