In an era where financial independence is a coveted goal, mastering the art of financial responsibility is the key to unlocking the doors to a secure and prosperous future. The journey toward fiscal empowerment begins with a conscious effort to understand, plan, and execute sound financial decisions. This comprehensive guide aims to provide you with the essential tools and knowledge to navigate the complex landscape of personal finance successfully.

Understanding Financial Responsibility

Financial responsibility is more than just managing your money; it’s about making informed choices that align with your long-term goals. At its core, it involves creating a healthy relationship with your finances, wherein you’re in control of your money rather than letting it control you. To embark on this journey, consider the following key principles:

- Budgeting Basics: The cornerstone of Financial Responsibility is creating and sticking to a budget. A well-thought-out budget ensures that you allocate your income to cover essential expenses, save for the future, and allow for discretionary spending. Numerous apps and tools can help you track your expenses and stay on budget.

- Emergency Fund: Life is unpredictable, and unexpected expenses can arise at any time. Building an emergency fund is crucial to provide a financial safety net. Aim to save at least three to six months’ worth of living expenses in a liquid account to cover unforeseen circumstances without derailing your financial plans.

- Debt Management: High-interest debt can be a significant impediment to financial well-being. Develop a strategy to tackle outstanding debts systematically. Prioritize high-interest debts first, such as credit card balances, and work your way down. Consider consolidating debts or negotiating with creditors to ease the burden.

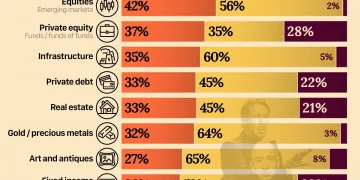

- Investing for the Future: Building wealth is not just about saving money; it’s also about investing wisely. Explore investment options that align with your risk tolerance, time horizon, and financial goals. Diversify your investments to spread risk and increase the likelihood of long-term growth.

- Insurance Coverage: Protecting yourself and your assets is a fundamental aspect of financial responsibility. Review and update your insurance coverage regularly to ensure it aligns with your current needs. This includes health insurance, life insurance, property insurance, and other relevant policies.

The Guide to Financial Responsibility in Action

Now that we’ve laid the foundation for understanding financial responsibility, let’s explore how to put this knowledge into practice:

- Create a Realistic Budget: Start by documenting your monthly income and expenses. Categorize your spending into fixed (e.g., rent, utilities) and variable (e.g., groceries, entertainment) expenses. Allocate a portion of your income to savings and debt repayment. Regularly review and adjust your budget as needed.

- Establish Financial Goals: Set short-term and long-term financial goals. Whether it’s saving for a vacation, a down payment on a home, or your retirement, having clear objectives helps guide your financial decisions. Break down larger goals into smaller, achievable milestones.

- Automate Savings and Investments: Take advantage of automation to ensure consistent savings and investments. Set up automatic transfers to your savings account and investment accounts. This not only makes the process seamless but also helps you stay disciplined in your financial journey.

- Educate Yourself: Stay informed about personal finance trends, investment strategies, and economic developments. Continuous learning equips you with the knowledge to make informed decisions and adapt to changing financial landscapes.

- Regularly Review Your Finances: Schedule regular check-ins with your finances. Review your budget, track your spending, and assess your progress toward financial goals. Make adjustments as needed to stay on course and address any challenges that may arise.

Conclusion

Empowering your wallet through financial responsibility is a transformative journey that requires dedication, discipline, and a commitment to lifelong learning. By understanding the core principles of budgeting, saving, investing, and protecting your assets, you can navigate the complexities of personal finance with confidence. This guide serves as a roadmap to help you achieve financial well-being and build a secure future for yourself and your loved ones. Take control of your financial destiny, and let the principles of financial responsibility guide you toward a brighter and more prosperous tomorrow.

Pocket Wise Kids is a fictional organization that focuses on promoting financial literacy among children. Through their engaging and educational resources, Pocket Wise Kids aims to equip children with the necessary skills and knowledge to make informed financial decisions. Children's financial literacy is an important topic to address, as it sets the foundation for a lifetime of responsible money management. By teaching children about money early on, we empower them to develop good financial habits and make sound financial choices as they grow older.