If you are an investor or looking to invest in real estate, you may have heard about the possibility of buying real estate with crypto in Dubai. With the rise of cryptocurrencies, particularly Bitcoin, and the increasing interest in real estate investments, the intersection of crypto and real estate investing has become a popular topic. In this article, we will explore the concept of buying real estate with crypto in Dubai, the advantages and challenges of crypto real estate investing, and provide a comprehensive guide for investors.

Table of Contents

- Introduction

- The Concept of Buying Real Estate with Crypto in Dubai

- The Advantages of Crypto Real Estate Investing

- The Challenges of Crypto Real Estate Investing

- Legal and Regulatory Framework for Crypto Real Estate Investing in Dubai

- How to Buy Real Estate with Crypto in Dubai: A Step-by-Step Guide

- Finding the Right Property

- Negotiating the Deal

- Paying with Crypto

- Closing the Deal

- Tax Implications of Crypto Real Estate Investing in Dubai

- Risks and Mitigation Strategies for Crypto Real Estate Investing in Dubai

- Top Tips for Successful Crypto Real Estate Investing in Dubai

- Conclusion

- FAQs

The Concept of Buying Real Estate with Crypto in Dubai

The concept of buying real estate with crypto in Dubai involves using cryptocurrencies, such as Bitcoin or Ethereum, to purchase real estate properties in Dubai. The idea of crypto real estate investing has gained popularity over the years as cryptocurrencies have gained wider acceptance and use. The process of buying real estate with crypto involves finding a seller who accepts crypto payments, negotiating the deal, and transferring the crypto payment to the seller’s crypto wallet.

The Advantages of Crypto Real Estate Investing

One of the main advantages of buying real estate with crypto in Dubai is the potential for a quick and seamless transaction. Crypto transactions are usually faster than traditional banking transactions, which can take days or even weeks to complete. Additionally, crypto transactions are secure and transparent, as they are recorded on the blockchain and cannot be altered. This ensures that the payment is tamper-proof and irreversible, reducing the risk of fraud or disputes.

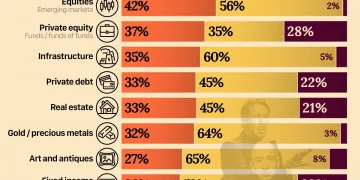

Another advantage of crypto real estate investing is the potential for capital gains. Cryptocurrencies are known for their volatility, and the value of a particular cryptocurrency can rise or fall dramatically over a short period of time. This means that if an investor buys real estate with crypto and the value of that crypto increases, the investor can potentially make a significant profit.

The Challenges of Crypto Real Estate Investing

While there are advantages to buying real estate with crypto in Dubai, there are also challenges that investors need to be aware of. One of the main challenges is the lack of regulatory framework around crypto real estate investing. Unlike traditional real estate transactions, which are governed by established legal frameworks, crypto real estate investing is still a relatively new concept that is not yet fully regulated.

Another challenge is the volatility of cryptocurrencies. While this can be an advantage for capital gains, it can also pose a risk to investors. Cryptocurrencies can experience sudden and significant price fluctuations, which can impact the value of the real estate investment.

Legal and Regulatory Framework for Crypto Real Estate Investing in Dubai

Dubai has recently taken steps to regulate the use of cryptocurrencies and blockchain technology, including the issuance of a regulatory framework for crypto assets. The Dubai Multi Commodities Centre (DMCC) has launched a crypto trading platform, which allows investors to trade in cryptocurrencies such as Bitcoin, Ethereum, and Litecoin.

Additionally, the Dubai Land Department (DLD) has partnered with the Dubai-based blockchain start-up, Smart Dubai, to develop a blockchain-powered platform for managing real estate transactions. The platform, called “Real Estate Self Transaction”, aims to streamline the real estate transaction process, reduce transaction times, and increase transparency and security.

While there is no specific legal framework for buying real estate with crypto in Dubai, the government has taken steps to regulate the use of crypto assets and blockchain technology. Investors should consult with legal experts to understand the legal implications and requirements for buying real estate with crypto in Dubai.

How to Buy Real Estate with Crypto in Dubai: A Step-by-Step Guide

If you are interested in buying real estate with crypto in Dubai, here is a step-by-step guide to help you navigate the process:

Finding the Right Property

The first step in buying real estate with crypto in Dubai is finding the right property. This involves conducting research on the real estate market in Dubai, identifying properties that meet your investment goals, and contacting sellers who accept crypto payments.

Negotiating the Deal

Once you have identified a property and contacted the seller, the next step is to negotiate the deal. This involves agreeing on the terms and conditions of the sale, including the price, payment method, and closing date.

Paying with Crypto

After the deal has been negotiated, the next step is to transfer the crypto payment to the seller’s crypto wallet. This involves verifying the seller’s wallet address, transferring the crypto to the wallet, and ensuring that the transaction is recorded on the blockchain.

Closing the Deal

The final step in buying real estate with crypto in Dubai is closing the deal. This involves completing the necessary paperwork, transferring ownership of the property, and receiving the keys to the property.

Tax Implications of Crypto Real Estate Investing in Dubai

Investors who buy real estate with crypto in Dubai may be subject to tax obligations. The tax implications of crypto real estate investing in Dubai depend on various factors, including the type of crypto asset used, the holding period, and the capital gains or losses generated from the investment.

Investors should consult with tax experts to understand the tax implications of crypto real estate investing in Dubai and ensure compliance with applicable tax laws.

Risks and Mitigation Strategies for Crypto Real Estate Investing in Dubai

Like any investment, buying real estate with crypto in Dubai involves risks. Some of the risks of crypto real estate investing include the volatility of cryptocurrencies, the lack of regulatory framework, and the potential for fraud.

Investors can mitigate these risks by conducting thorough research, working with reputable sellers and intermediaries, and consulting with legal and tax experts.

Top Tips for Successful Crypto Real Estate Investing in Dubai

Here are some top tips for successful crypto real estate investing in Dubai:

- Conduct thorough research on the real estate market in Dubai and identify properties that meet your investment goals.

- Work with reputable sellers and intermediaries who have experience in crypto real estate transactions.

- Consult with legal and tax experts to understand the legal and tax implications of crypto real estate investing in Dubai.

- Be prepared for the potential risks and take steps to mitigate them.

- Stay up-to-date with developments in the crypto and real estate markets in Dubai.

Conclusion

Buying real estate with crypto in Dubai is a new and exciting opportunity for investors. While there are advantages and challenges to crypto real estate investing, the potential for quick and secure transactions and capital gains make it a compelling option for many investors. By following the steps outlined in this article and taking the necessary precautions, investors can successfully navigate the crypto real estate investing landscape in Dubai.

FAQs

Is it legal to buy real estate with crypto in Dubai?

Yes, it is legal to buy real estate with crypto in Dubai, but investors should consult with legal experts to understand the legal requirements and implications.

What are the advantages of buying real estate with crypto in Dubai?

Some advantages of buying real estate with crypto in Dubai include quicker transaction times, increased transparency, and potentially higher capital gains.

What are the risks of buying real estate with crypto in Dubai?

Risks of buying real estate with crypto in Dubai include the volatility of cryptocurrencies, the lack of regulatory framework, and the potential for fraud.

How do I pay for real estate with crypto in Dubai?

To pay for real estate with crypto in Dubai, investors must transfer the crypto payment to the seller’s crypto wallet, ensuring that the transaction is recorded on the blockchain.

What are the tax implications of buying real estate with crypto in Dubai?

The tax implications of buying real estate with crypto in Dubai depend on various factors, including the type of crypto asset used, the holding period, and the capital gains or losses generated from the investment. Investors should consult with tax experts to understand the tax implications and ensure compliance with applicable tax laws.

In summary, buying real estate with crypto in Dubai is a new and exciting opportunity for investors. While there are challenges and risks involved, the potential benefits make it a compelling option for many. By following the steps outlined in this article and taking the necessary precautions, investors can successfully navigate the crypto real estate investing landscape in Dubai.